Closing a business in Florida is a common reality. According to Forbes in 2024, approximately 20% of new small businesses fail during their first year, and about 50% fail within the first five years.

Understanding how to close your business properly can make the process smoother and less stressful. Ending operations is about staying compliant, tying up financial and legal loose ends, and closing the chapter on your hard work the right way.

At Portalatin Business Law Firm, we work closely with entrepreneurs from diverse backgrounds, offering support in Spanish, Portuguese, and English. Our proactive legal approach helps protect your company and secure your brand’s future.

Key Takeaways

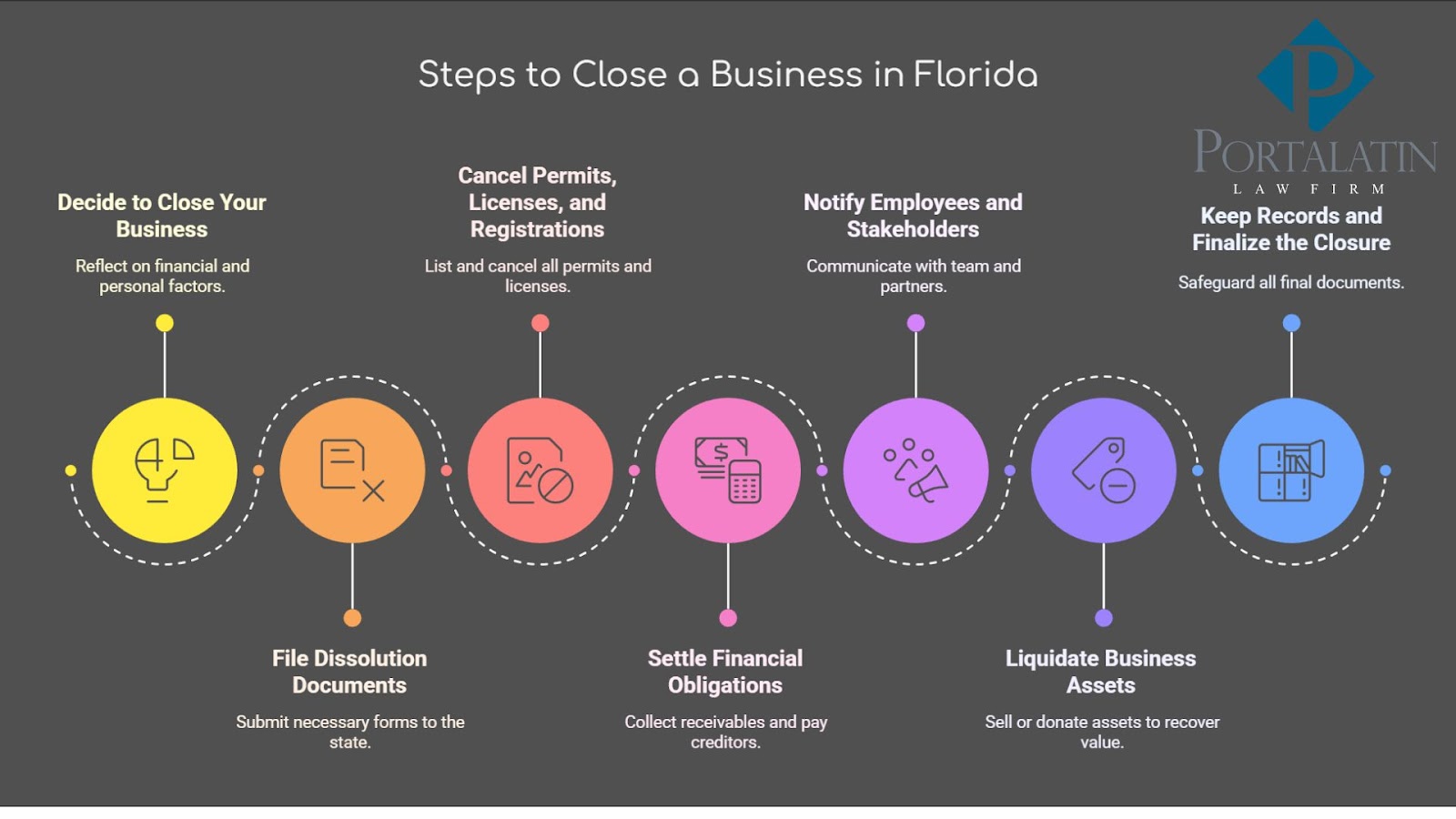

- When closing a business, reflect on your reasons, consult trusted advisors, and document your decision.

- Filing dissolution documents, canceling licenses, and settling outstanding debts and taxes allow for compliance and prevent future liabilities.

- Inform employees, customers, suppliers, and creditors about the closure in a clear and timely manner.

- It is important to liquidate assets, keep records, and understand Florida-specific regulations during this process.

Step 1: Decide to Close Your Business

Closing a business in Florida starts with making a tough personal decision. You’ve put your heart into your business, and deciding to shut it down means weighing both the emotional and practical sides of the situation. Make sure to ask yourself the following questions:

- Are finances pushing you to consider an exit?

- Is the stress affecting your well-being?

- Have market changes made the business unsustainable?

Talk with your partners, trusted advisors, or even a business counselor. It helps to get different perspectives and document your reasons. This clarity makes the next steps feel more manageable and gives you confidence in moving forward.

Step 2: File Dissolution Documents

Filing dissolution documents officially lets the state know that you are closing your doors. In Florida, this step is key for LLCs, corporations, and partnerships to avoid future tax bills and other ongoing obligations.

Start by gathering the necessary forms from the Florida Department of State website. The process might vary slightly depending on your business type, so double-check what applies to you. Here’s a quick rundown of what to expect:

- LLCs and Corporations: Look for the Articles of Dissolution form. This document cancels your legal existence with the state.

- Partnerships: Make sure to follow the guidelines in your partnership agreement and any state-specific rules.

Take your time reviewing the instructions. Filing correctly now prevents headaches down the road. If anything feels unclear, don’t hesitate to ask for help from a legal advisor who understands Florida’s rules.

Step 3: Cancel Permits, Licenses, and Registrations

Once your dissolution documents are filed, it’s time to cancel any permits, licenses, and registrations that you no longer need. This prevents any unwanted bills or legal issues later on.

Start by listing all the permits and licenses your business holds. Common ones in Florida include:

- Business licenses from your city or county

- Professional or trade permits

- Sales tax and employer identification registrations

Check each agency’s website for cancellation instructions, and keep a record of every cancellation. This step makes sure that your business isn’t accidentally held responsible for ongoing fees or requirements.

Step 4: Settle Financial Obligations

Taking care of your financial matters is a must. This step means making sure you pay off debts, collect any money owed, and handle your final tax filings. Here’s what to do:

- Collect Outstanding Receivables: Reach out to customers who still owe you money. Getting these funds early can ease the financial strain.

- Pay Off Creditors: Contact suppliers, lenders, and other creditors to settle any remaining bills. Clearing these debts helps prevent future claims against you.

- Handle Final Tax Filings: File your final state and federal tax returns. Double-check with the IRS or a tax professional to confirm that you’ve met all your obligations.

Step 5: Notify Employees and Stakeholders

Informing your team and others connected to your business is vital. Clear communication helps reduce uncertainty and lets everyone know what to expect. Here’s how to approach it:

- Employees: Let your staff know about the closure as soon as possible. Explain the reasons, what the timeline looks like, and how their final pay will be handled. Make sure you follow labor laws, including any required notice periods.

- Customers: Inform regular customers about the closure and guide them on what to do next. This might include providing alternative contacts or resources.

- Suppliers and Creditors: Reach out to those you owe or receive services from. Clear communication can help settle any remaining matters smoothly.

Step 6: Liquidate Business Assets

When it’s time to close, you’ll need to turn any remaining business assets into cash. This step allows you to recover as much value as possible. Here’s how to get started:

- Inventory and Equipment: Identify what you have and decide whether to sell, donate, or scrap items. A quick online search can help you find fair market values.

- Property and Contracts: Consider any leases, trademarks, or other intangibles that could have value. Sometimes these can be sold to another business or negotiated out.

- Plan the Sale: Create a simple strategy. For instance, you might hold a clearance sale, list items online, or work with a local broker who understands the market.

Make sure you use the proceeds of the sale of assets to pay outstanding debts first, before distributing money to any shareholders or members.

Step 7: Keep Records and Finalize the Closure

Once you’ve wrapped up the major tasks, it’s important to keep the paperwork in order. This means saving all the records related to the business closure for future reference. Not only does this protect you if questions arise later, but it also helps you stay compliant with state and federal guidelines.

- Document Everything: Keep copies of dissolution documents, cancellation confirmations, final tax returns, and correspondence with creditors or employees.

- Organize Financial and Legal Records: Store these documents in a secure place, either digitally or in a physical file, for at least three to seven years, as recommended.

- Review and Confirm: Double-check that all tasks are complete. This final review makes sure that you haven’t missed any important details that could affect your future.

Taking the time to organize your records not only gives you peace of mind but also sets the stage for a clean exit. With your files in order, you can confidently move forward into the next chapter.

Florida-Specific Legal and Tax Implications

Florida has its own set of rules when it comes to closing a business. Knowing these details can save you time and prevent future headaches.

- State Regulations: Florida’s rules might be different from other states. For instance, make sure you check if any special tax clearances or additional forms are needed by the Florida Department of State.

- Tax Issues: Besides filing your final federal and state returns, be aware of any local taxes or fees that might still apply. A quick chat with a local tax professional can help clarify these points.

- Useful Resources: Bookmark the Florida Department of State and SBA websites for up-to-date guidelines. These sites are great for making sure you don’t miss any state-specific steps.

Coping with the Emotional Impact and Planning for the Future

Closing a business is a big emotional transition. It’s normal to feel a mix of relief, sadness, and uncertainty. Consider these ideas to help you move forward:

- Give Yourself Time: Recognize that it’s okay to feel upset. Take a moment to process the change, whether that means talking it out with a friend or simply taking some time off.

- Seek Support: Consider speaking with a business counselor or joining a local support group. Sometimes sharing your experience can make the load feel lighter.

- Plan Ahead: Think about what comes next. Use this opportunity to learn from your experience and set new goals. Planning your next steps can help you regain a sense of control.

Plan Your Next Chapter with Confidence

Closing your business with confidence allows you to move forward with peace of mind. By wrapping up loose ends, you’ll be ready to embrace new opportunities and pursue your next goal with certainty.

At Portalatin Business Law Firm, we combine solid legal insight with a personal touch, supporting entrepreneurs like you every step of the way. If you’re ready to protect your future, visit our contact page to get in touch. We’re here to help you take the next step!