Florida’s vibrant small business community is evident, with approximately 3.1 million small businesses accounting for 99.8% of all businesses in the state, as reported by the U.S. Small Business Administration.

This growing environment shows the importance of understanding the intricacies of forming and maintaining a Limited Liability Company (LLC) in Florida.

At Portalatin Business Law Firm, we help entrepreneurs go beyond basic LLC formation by building proactive legal frameworks that strengthen their businesses from day one. Unlike traditional law firms, we align legal strategy with branding, trademark protection, and long-term business goals.

Key Takeaways

- Form an LLC by choosing a unique name, appointing a registered agent, and filing Articles of Organization.

- Stay compliant by filing annual reports, handling taxes, and keeping accurate records.

- Some businesses need additional licenses and permits based on industry and location.

- LLCs must remain compliant based on the laws and regulations of the state.

What Are the Florida LLC Naming Rules?

A Florida LLC name must be unique and include “Limited Liability Company,” “LLC,” or “L.L.C.” It cannot contain words that imply government affiliation (e.g., “FBI” or “Treasury”) or restricted terms like “Bank” or “Attorney” unless additional requirements are met.

How to Check If Your Business Name Is Available in Florida?

Search the Florida Division of Corporations’ Sunbiz database to confirm name availability. If the name is taken, you must choose a different one.

How to Reserve a Business Name in Florida?

You can reserve a name for up to 120 days by filing a name reservation request with the Florida Division of Corporations and paying a small fee.

Do You Need a DBA for Your Florida LLC?

A DBA (Doing Business As) is required if your LLC operates under a name different from its registered name. You must register a DBA with the state and comply with local business regulations.

How to Start an LLC in Florida? A Step-by-Step Guide

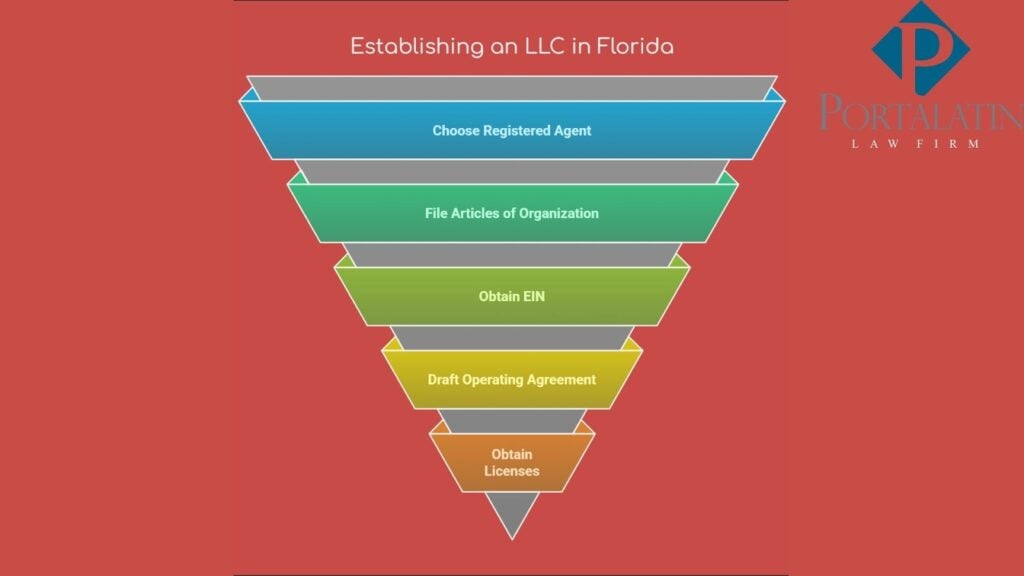

Starting an LLC in Florida involves the following five key steps:

Step 1: Choose a Registered Agent for Your LLC

A registered agent must be a Florida resident or a business authorized to accept legal documents on behalf of your LLC. They must have a physical address in Florida and be available during business hours.

Step 2: File Articles of Organization in Florida

Submit the Articles of Organization to the Florida Division of Corporations with details like your LLC’s name, address, registered agent information, and business purpose. The filing fee is $125 and processing takes 5–10 business days.

Step 3: Get an EIN for Your Florida LLC

Apply for an Employer Identification Number (EIN) through the IRS website. This number is required for tax filings, hiring employees, and opening a business bank account.

Step 4: Draft an Operating Agreement

An Operating Agreement outlines ownership percentages, management structure, and financial arrangements. While not legally required, it helps prevent disputes and clarifies business operations.

Step 5: Obtain Business Licenses and Permits

Business license requirements vary by industry and location. Check with the Florida Department of State and local government offices (city and county) to determine which permits apply to your LLC.

Compliance Requirements for a Florida LLC

Florida LLCs must meet the following compliance requirements:

Annual Report Filing

Florida LLCs must file an Annual Report with the Florida Division of Corporations to stay active. The deadline is May 1st each year, and the fee is $138.75. Late filings result in a $400 penalty.

Tax Obligations

LLCs in Florida are pass-through entities, meaning profits are taxed on the owner’s personal tax return. However, LLCs must collect and remit sales tax if selling taxable goods and pay employer taxes if they have employees.

Maintaining Business Records

LLCs must keep accurate records of financial transactions, operating agreements, meeting minutes, and tax filings.

Common Compliance Mistakes

Missing the Annual Report deadline, failing to renew business licenses, not collecting required sales tax, and improperly classifying employees as independent contractors can lead to penalties and legal issues.

Secure Your Florida LLC with Experienced Legal Support

Forming an LLC is just the first step in protecting yourself and your business. Confirming compliance, protecting your brand, and reducing liability are key to long-term success.

At Portalatin Business Law Firm, we provide legal strategies tailored to businesses’ goals, starting from LLC formation to trademark protection and business transactions.

If you want to protect your business from day one, schedule a consultation with our team today.