If you think forming a limited liability company (LLC) or corporation automatically shields your personal assets, think again. The truth is, courts can “pierce the corporate veil” and hold business owners personally liable, especially if legal formalities aren’t followed.

This concept may sound intimidating, but understanding it is necessary for protecting your business.

At Portalatin Business Law Firm, we help Florida entrepreneurs set up smart, proactive legal structures that minimize this risk from day one. If you’re launching a startup or scaling your brand, our approach is about securing your future.

Key Takeaways:

- Forming an LLC or corporation does not guarantee personal asset protection. Courts can allow opposing parties to pierce the corporate veil if legal formalities are ignored or misused.

- Common reasons for veil piercing include commingling personal and business finances, undercapitalization, or failure to observe corporate formalities.

- Maintaining separate financial accounts, proper documentation, and compliance with legal requirements are necessary to preserving liability protection.

What Is the Corporate Veil and Why Does It Matter?

Most small business owners form an LLC or corporation, believing their personal assets are protected. And that’s true if the business is operated correctly. This legal protection is known as the “corporate veil,” and it’s what separates your company’s debts and liabilities from your own bank account, home, or car.

How the Corporate Veil Protects Business Owners

When the corporate veil is intact, it creates a legal boundary between you and your business. For example, if your company is sued or takes on debt, your personal finances are shielded, as long as you’ve respected corporate formalities like separate accounts, proper contracts, and documented decisions.

Most courts, especially in Florida, are strict about when this protection can be lifted. But the key takeaway is this: when business owners ignore the rules, that shield can break.

Key Benefits of Limited Liability Structures

Setting up an LLC or corporation is a strategic move that:

- Keeps your personal assets off the table in legal disputes

- Builds trust with vendors, banks, and clients

- Signals professionalism to investors and partners

- Supports brand protection and long-term growth

This strategy within this structure becomes even more important if you’re working with expanding companies with valuable intellectual property. At Portalatin Business Law Firm, we help you understand and maintain this legal boundary from the start, so your company stays secure and future-ready.

When Can the Corporate Veil Be Pierced?

“Piercing the corporate veil” is a legal phrase that describes the owners of a corporation losing the limited liability that having a corporation or LLC provides them.

While forming an LLC or corporation provides a layer of protection for business owners, certain actions can lead courts to pierce the corporate veil, holding individuals personally liable. Here are common legal grounds:

- Fraud or Misrepresentation: If the business entity is used to perpetrate fraud or mislead creditors, courts may disregard the corporate structure.

- Undercapitalization: Operating a business without sufficient capital to cover potential liabilities can be a factor in veil piercing decisions.

- Failure to Observe Corporate Formalities: Neglecting to maintain separate financial records, hold regular meetings, or follow other corporate formalities can indicate that the business is not a separate entity.

- Commingling of Assets: Mixing personal and business finances blurs the line between the individual and the corporation, potentially leading to personal liability.

- Alter Ego Theory: When the business is merely an extension of the owner’s personal affairs, lacking independence, courts may find the owner personally liable.

Real-World Examples of Veil Piercing

Understanding how courts apply these principles can be illustrated through real cases:

- Walkovszky v. Carlton: In this case, the owner of multiple cab companies, each minimally capitalized, was sued after a pedestrian was injured. The court found that the structure was designed to defraud the public, leading to personal liability for the owner.

- Kinney Shoe Corp. v. Polan: Here, the court pierced the corporate veil because the corporation was undercapitalized and failed to observe corporate formalities, holding the individual owner personally liable for the corporation’s debts.

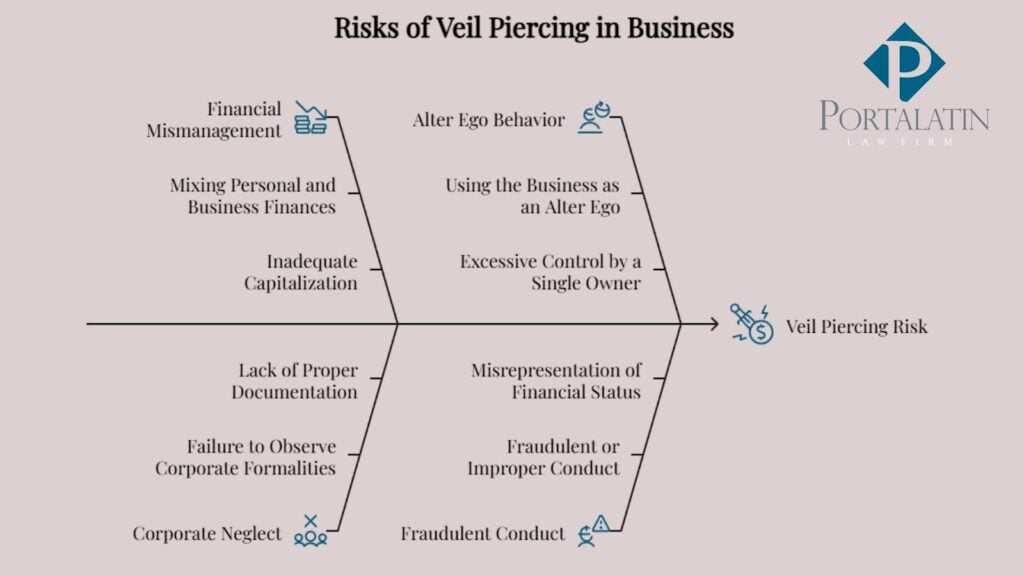

7 Signs Your Business Is at Risk of Veil Piercing

Even with an LLC or corporation, certain practices can expose you to personal liability. Here are seven common red flags:

- Mixing Personal and Business Finances

Using your business account to pay personal expenses, or vice versa, blurs the line between you and your company. Courts view this as a failure to maintain the entity’s separate existence. - Inadequate Capitalization

Starting or operating your business without sufficient funds to cover foreseeable liabilities can indicate that the company is a mere shell, increasing the risk of veil piercing. - Failure to Observe Corporate Formalities

Neglecting to hold regular meetings, maintain records, or follow other statutory requirements undermines the legitimacy of your business entity. - Using the Business as an Alter Ego

Treating the company as an extension of yourself, making decisions without consulting other members or disregarding the entity’s separate interests, can lead to personal liability. - Fraudulent or Improper Conduct

Engaging in deceitful practices, such as misrepresenting the company’s financial status or transferring assets to avoid creditors, can prompt courts to pierce the veil. - Lack of Proper Documentation

Failing to document transactions, agreements, or financial decisions erodes the distinction between the business and its owners. - Excessive Control by a Single Owner

When one individual exerts complete control over the company without checks and balances, it may suggest that the business lacks an independent existence.

How These Risks Appear in Daily Operations

These red flags often manifest in everyday business activities:

- Personal Use of Business Assets: Using company vehicles or equipment for personal errands without proper documentation.

- Informal Agreements: Making significant business decisions or transactions based on verbal agreements without written contracts.

- Neglecting Compliance Requirements: Overlooking the filing of annual reports, renewing business licenses, or maintaining a registered agent.

- Inconsistent Record-Keeping: Failing to keep accurate and separate financial records for the business, leading to confusion and potential legal issues.

How to Prevent Veil Piercing in Your Small Business

Maintaining the corporate veil requires diligent adherence to legal formalities. Key practices include:

- Separate Financial Accounts: Establish and use distinct bank accounts for business transactions to prevent commingling of funds.

- Proper Documentation: Keep accurate records of business decisions, including operating agreements or bylaws, meeting minutes and resolutions.

- Adequate Capitalization: Make sure your business has sufficient capital to meet its obligations, demonstrating financial stability.

- Compliance with Regulations: Stay current with all required filings and licenses to maintain good standing.

Key Compliance Practices Every Owner Needs

Beyond legal formalities, consistent compliance practices fortify your business’s liability protection:

- Use of Business Name: Clearly identify your business entity in all contracts and communications to reinforce its separate legal status.

- Regular Meetings: Hold and document regular meetings, even for single-member LLCs, to demonstrate active governance.

Best Practices for Financial Separation

Financial separation is crucial in upholding the corporate veil:

- Dedicated Business Accounts: Use separate accounts for all business transactions to prevent financial overlap.

- Clear Record-Keeping: Maintain detailed records of all financial activities, including invoices and receipts, to establish transparency.

- Professional Assistance: Consider engaging accountants or bookkeepers to manage finances and confirm compliance with financial regulations.

Implementing these practices helps maintain the integrity of your business entity, safeguarding your personal assets from potential liabilities.

Florida-Specific Considerations for Business Owners

In Florida, courts are particularly cautious when it comes to piercing the corporate veil. Simply failing to follow corporate formalities or having a closely held corporation is not enough. There must be multiple factors at play or evidence of fraudulent or improper use of the corporate form that caused harm to a third party.

Furthermore, Florida courts have consistently held that the mere existence of a single-member LLC does not automatically justify piercing the corporate veil.

How Portalatin Business Law Firm Helps You Stay Protected

At Portalatin Business Law Firm, we understand that forming an LLC or corporation is just the first step in protecting your personal assets. Our legal services are designed to help Florida entrepreneurs maintain the integrity of their business entities and avoid the pitfalls that can lead to piercing the corporate veil. We assist clients in:

- Establishing and maintaining proper corporate formalities, including drafting operating agreements and bylaws.

- Confirming adequate capitalization to meet business obligations.

- Implementing best practices for financial separation between personal and business assets.

- Providing ongoing legal counsel to handle compliance requirements and avoid actions that could jeopardize limited liability protections.

Our proactive approach is tailored to support your business’s growth while safeguarding your personal assets.

Trademark Protection and International Support

In addition to corporate compliance, protecting your brand is important. Portalatin Business Law Firm offers comprehensive trademark registration services to shield your business identity from imitators. We work closely with branding agencies to make sure that your trademarks are not only registered but also aligned with your business goals.

By aligning legal strategies with your business objectives, Portalatin Business Law Firm provides peace of mind and a solid foundation for your business’s future.

Ready to Build a Safer Legal Foundation?

Piercing the corporate veil might sound like a technical legal issue, but for small business owners, it’s a real-world risk with personal consequences. The good news? It’s completely avoidable when you take the right steps from the start.

At Portalatin Business Law Firm, we help entrepreneurs in Florida build legal frameworks that protect what matters most. Our team makes sure your business structure meets the legal standards courts look for, reducing liability and giving you confidence to grow.

We also understand that understanding U.S. law as an international founder can be daunting. That’s why we offer services in Spanish, Portuguese, and English, providing accessible, culturally aligned legal support to clients across the globe.

If you’re ready to strengthen your legal foundation, contact Portalatin Business Law Firm today. We’ll help you keep your business protected, your brand secure, and your future on solid ground.