Starting a business, or protecting one, requires a legal structure, especially when trust is part of the equation. If someone is making decisions on your behalf, or if you’re trusted to act in someone else’s best interest, you’re likely in a fiduciary relationship. Knowing what that means and what’s legally required can help you avoid costly mistakes.

At Portalatin Business Law Firm, we help entrepreneurs build strong legal foundations that support growth and reduce risk. That includes clarifying responsibilities like fiduciary duty so business owners know exactly where they stand.

Key Takeaways

- Fiduciary duty is a legal obligation to act in someone else’s best interest.

- Common fiduciaries include business partners, directors, trustees, and advisors.

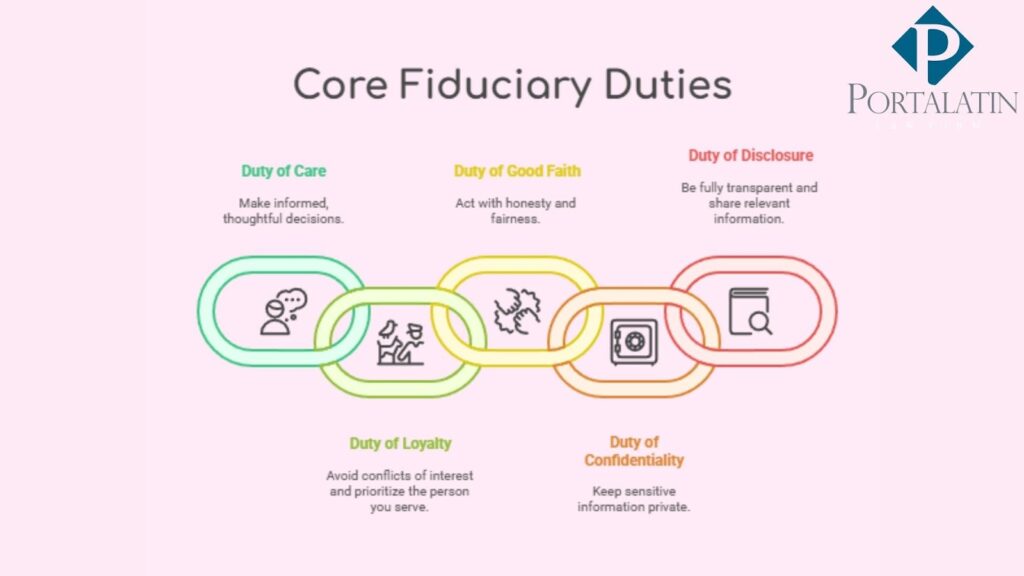

- The five core duties are care, loyalty, good faith, confidentiality, and disclosure.

- Breaching fiduciary duty can lead to lawsuits, removal, and financial penalties.

What Is Fiduciary Duty?

Fiduciary duty means putting someone else’s interests ahead of your own. It’s a legal obligation based on trust. The person with the duty is the fiduciary. The person they serve is the principal.

In business and law, fiduciaries include:

- Company directors

- Financial advisors

- Lawyers

- Trustees

They must act with care, loyalty, honesty, and full disclosure. They can’t use their position for personal gain without permission. If they do, it’s a breach, and that can lead to lawsuits or removal.

Who Is a Fiduciary? (Roles and Relationships)

A fiduciary is anyone who has the power and legal duty to act on someone else’s behalf with trust and loyalty. They’re expected to put the other person’s interests first, always.

Common fiduciaries include:

- Business partners: Owe each other loyalty and honesty.

- Corporate directors and officers: Must protect the interests of shareholders.

- Trustees: Manage property or money for someone else.

- Financial advisors: Make decisions that benefit the client, not themselves.

- Attorneys: Must act in their client’s best interest at all times.

- Real estate agents: Owe duties to buyers or sellers, depending on who they represent.

Not everyone in a position of authority is a fiduciary. The key is whether there’s a relationship built on trust where one person depends on the other’s judgment.

Fiduciary relationships can be:

- Formal: Set by law or contract (like a trustee or attorney).

- Informal: Based on the facts and level of trust involved.

If one person has power over another’s money, rights, or decisions, and the other relies on them, the law often sees that as a fiduciary relationship.

The 5 Core Fiduciary Duties

Fiduciary duty is made up of five main responsibilities. If you’re a fiduciary, you’re legally required to follow all of them. Breaking even one can lead to serious legal trouble.

Here are the five core duties:

- Duty of Care

Make informed, thoughtful decisions. You must act as a reasonably careful person would in the same situation. - Duty of Loyalty

Never put your own interests ahead of the person you serve. Avoid conflicts of interest. Don’t compete or take hidden benefits. - Duty of Good Faith

Always act with honesty and fairness. Don’t cut corners or act with bad intent, even if technically legal. - Duty of Confidentiality

Keep sensitive information private. Don’t share or use it for your own benefit. - Duty of Disclosure

Be fully transparent. Share anything that could affect the other person’s decisions or trust in you.

Key Examples of Fiduciary Duty in Practice

Fiduciary duty shows up in real-world situations where trust and responsibility are high. Here are common examples where the law expects someone to act in another’s best interest:

- Corporate Directors and Officers

Must make decisions that benefit shareholders, not themselves. For example, they can’t use insider info to make personal stock trades. - Business Partners

Each partner owes loyalty and fairness to the other. That means no secret deals or competing businesses on the side. - Trustees

Manage assets or money for someone else, like in a will or trust. They can’t mix those funds with their own or make risky moves. - Financial Advisors

Must recommend investments that suit the client’s needs, not ones that earn them higher commissions. - Attorneys

Have to protect their clients’ interests, keep information private, and avoid conflicts, even if it means turning down a case.

Consequences of Breaching Fiduciary Duty

When a fiduciary breaks their duty, the law takes it seriously. The harmed party can sue, and the fiduciary may face major legal and financial consequences.

Common outcomes include:

- Civil lawsuits

The injured party can claim damages, lost profits, or get back property wrongly used. - Court-ordered removal

Fiduciaries like trustees or company directors can be removed from their role. - Punitive damages

In serious cases, courts may award extra damages to punish bad behavior. - Injunctions

A court can order the fiduciary to stop certain actions immediately.

Signs of a breach include:

- Hiding key information

- Using inside knowledge for personal gain

- Failing to act in the other person’s best interest

- Not disclosing a conflict of interest

If you suspect a breach, act quickly. Document what happened, review any agreements, and speak with a business lawyer. Delaying can weaken your legal options.

Know Your Responsibilities. Protect Your Business.

Understanding fiduciary duty is part of running a responsible, trustworthy business. Clarity and compliance can protect what you’ve built and strengthen the relationships behind it.

At Portalatin Business Law Firm, we help entrepreneurs do exactly that: build legal systems that support smart decisions, reduce risk, and protect long-term success. If you’re ready to align your legal structure with your business goals, we’re here to help.

Start here to speak with us directly.