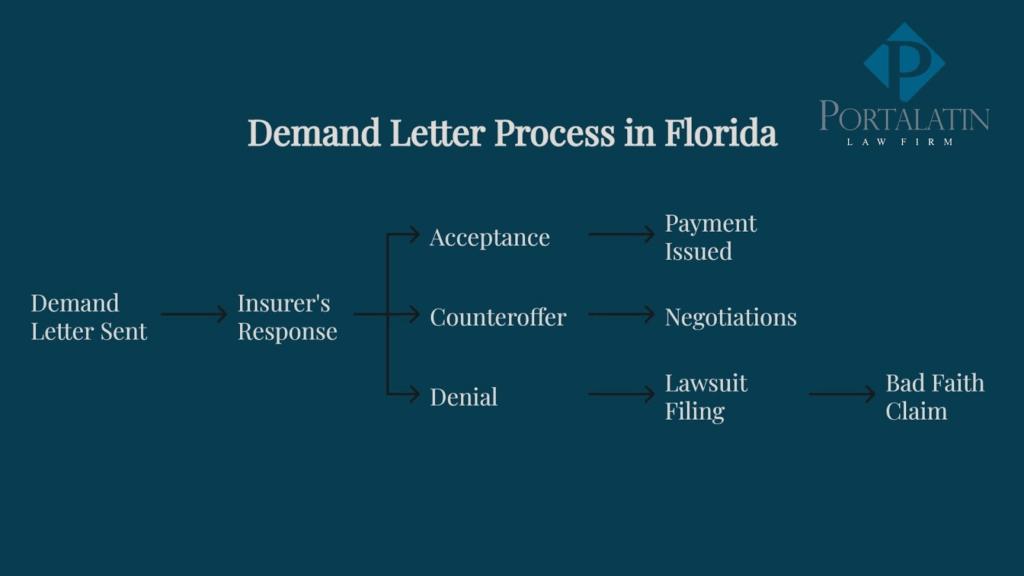

When your attorney sends a demand letter, it signals the start of serious negotiations with the other party. The letter lays out your position, supporting evidence, and the resolution you’re seeking. What happens next usually follows a few clear paths: the other side may accept the demand, issue a counteroffer, or deny it outright.

For business owners managing brands and contracts, this stage can feel uncertain. That’s where Portalatin Business Law Firm comes in. Instead of treating the demand letter as a single event, our firm helps entrepreneurs see it as part of a broader legal plan that protects their company, minimizes liability, and protects their brand.

With services offered in Spanish, Portuguese, and English, and a deep understanding of both U.S. and international business needs, Portalatin makes sure that clients are prepared not just for negotiations, but for long-term success.

Key Takeaways

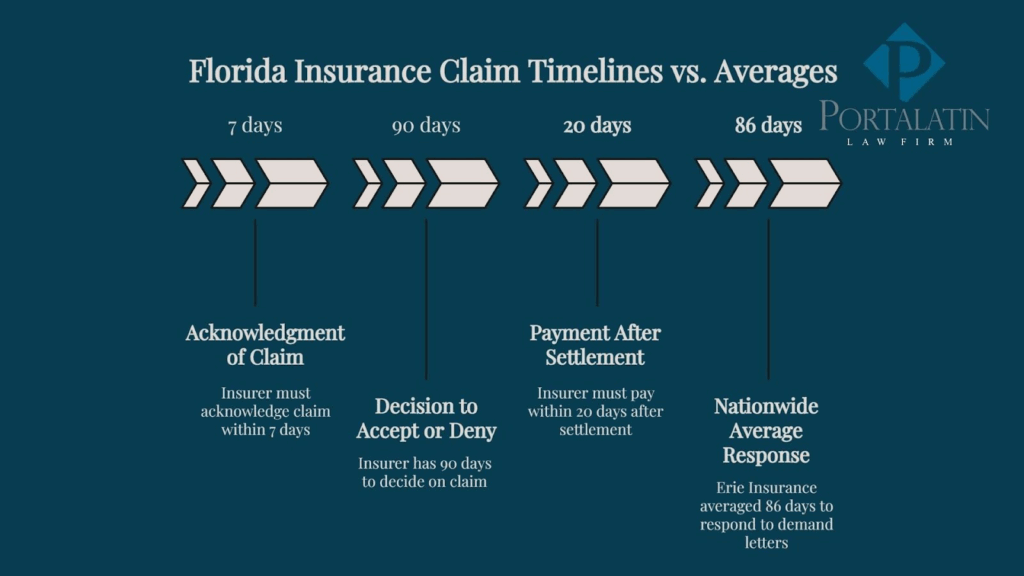

- Insurers must acknowledge a claim within 7 days and issue a decision within 90 days.

- If accepted, settlement payments must be made within 20 days.

- Unreasonable delays or denials may trigger bad faith claims under Florida law.

- Strong evidence and legal guidance give entrepreneurs the best chance at a fair and timely outcome.

What Is a Demand Letter?

A demand letter is a formal written request that your attorney sends to the opposing party or their insurer. It outlines the dispute, presents supporting evidence such as contracts, invoices, or medical records, and states the resolution you expect.

In Florida, this step is often the turning point between informal discussions and formal negotiations.

Demand Letters Under Florida Law

Florida law sets specific standards for how insurers handle claims. According to Florida Statute §627.70131, insurers must acknowledge a claim or communication within 7 days. Once they receive proof of loss, they have 90 days to accept or deny the claim unless extraordinary circumstances apply.

These rules create a legally enforceable timeline, meaning an insurer that drags its feet risks regulatory penalties or even a bad-faith claim.

What Happens After a Demand Letter Is Sent in Florida?

Once your attorney sends a demand letter, the ball is in the insurer’s court. In Florida, three outcomes are most common:

- Acceptance: The insurer agrees to pay the demand amount, either in full or in part. This is the fastest path to resolution.

- Counteroffer: More often, the insurer responds with a lower number. Negotiation begins, and your attorney pushes for fair compensation.

- Denial: The insurer refuses to pay, claiming the demand is unjustified or outside policy coverage.

If an insurer unreasonably denies or stalls payment, they can be sued for bad faith. This allows policyholders to seek extra damages beyond the original claim, including attorney’s fees and, in some cases, punitive damages. For business owners, this protection is critical because it keeps insurers accountable and discourages them from using delay tactics as leverage.

How Long Does It Take to Get a Response to a Demand Letter in Florida?

Florida law gives clear deadlines for insurers once a demand letter or proof of loss is submitted. While each case is unique, these statutes help set expectations:

- Acknowledgment: Florida insurers must acknowledge receipt of a claim or communication within 7 days.

- Decision Window: Insurers must accept or deny a claim within 90 days of receiving proof of loss, unless there are uncontrollable circumstances.

- Payment Deadline: If the claim is accepted, payment must be made within 20 days of a written settlement agreement.

Here’s a breakdown of Florida’s timelines compared to real-world averages:

| Stage | Florida Legal Deadline | Real-World Behavior | Source |

| Acknowledgment of claim | 7 days | Usually confirmed within a week | Fla. Stat. §627.70131(1)(a) |

| Decision to accept or deny | 90 days | Many insurers respond earlier, but some push right up to the deadline | Fla. Stat. §627.70131(7)(a) |

| Payment after settlement | 20 days | Checks often arrive within 2–4 weeks | Fla. Stat. §627.4265 |

| Average insurer response (nationwide data) | No federal standard | One review found Erie Insurance averaged 86 days to respond to demand letters | Miller & Zois dataset |

What If the Other Side Delays or Denies the Claim in Florida?

Even though Florida law sets clear deadlines, insurers sometimes drag their feet or deny valid claims. For business owners, this can be frustrating and costly. Here’s how Florida law addresses these scenarios:

Delay Tactics

Some insurers push the full 90-day decision window before responding, hoping you’ll accept a lower offer out of impatience. Others may request unnecessary documents to stall the process. While they can ask for legitimate proof of loss, endless delays may violate state law.

Denials

When an insurer denies your claim outright, they must provide a written explanation. If that denial is unreasonable or unsupported by the facts, Florida law gives you powerful recourse.

Florida’s Bad Faith Law

Under Florida Statute §624.155, policyholders can bring a bad faith claim if an insurer fails to act fairly and honestly in settling a claim. This allows you to pursue:

- Extra damages caused by the delay or denial

- Attorney’s fees

- Punitive damages in cases of willful misconduct

For entrepreneurs, this means you’re not powerless if an insurer stalls or plays hardball. A demand letter backed by Florida’s bad faith statute puts real pressure on the other side, since the financial consequences of noncompliance can exceed the original settlement value.

What Evidence Strengthens Your Position in Florida?

A demand letter is only as strong as the evidence behind it. In Florida, providing detailed, organized documentation not only speeds up the insurer’s decision but also strengthens your case if you need to pursue a lawsuit or a bad faith claim.

Here are the most important categories of evidence for business owners and entrepreneurs:

Contracts and Agreements

- Signed contracts, purchase orders, and service agreements

- Any clauses outlining responsibilities, deadlines, or penalties

- Amendments or emails that modify the original terms

Financial Records

- Invoices and receipts showing expenses or losses

- Bank statements or payroll records if revenue or wages were affected

- Proof of lost profits, such as canceled orders or missed business opportunities

Property and Damage Documentation

- Repair estimates, appraisals, or inspection reports

- Photos and videos of the damage or defective product

- Maintenance records showing you upheld your responsibilities

Brand and Intellectual Property Evidence

- Registered Florida or U.S. trademarks (USPTO filings, Florida DBPR business registrations)

- Cease-and-desist letters or infringement evidence if another party harmed your brand

- Marketing or branding materials that show your reputation and goodwill at risk

For Personal or Mixed Claims (if applicable)

- Medical bills, treatment notes, or rehabilitation costs for injury-related disputes

- Professional reports linking the injury or loss to the incident in question

Do I Need a Lawyer for This Process in Florida?

While anyone can send a demand letter, the response you get, and the outcome that follows often depend on the strength of the letter and the legal strategy behind it.

In Florida, the stakes are high: insurers must follow strict deadlines, and bad faith remedies are available if they fail to act fairly. But without an attorney monitoring those deadlines and pushing back against delay tactics, business owners risk leaving money on the table or waiting far longer than the law allows.

In practice, having a lawyer by your side confirms:

- Demand letters are drafted with the strongest supporting evidence.

- Florida’s statutory deadlines (7-day acknowledgment, 90-day decision, 20-day payment) are tracked and enforced.

- Negotiations remain fair, and lowball offers are met with counter-strategies.

- Bad faith remedies are available if the insurer refuses to comply with the law.

Protect Your Business Beyond the Demand Letter

For entrepreneurs, a demand letter is only one piece of the bigger picture. The real advantage comes from having a legal partner who not only handles disputes but also builds protections for the future. Portalatin Business Law Firm provides that partnership.

Our firm combines corporate, trademark, and contract experience with a forward-thinking approach. By offering services in Spanish, Portuguese, and English, Portalatin Law bridges cultural and legal gaps, making sure Florida entrepreneurs and international business owners alike have the protection they need.

If you are ready to protect your business today while preparing it for tomorrow, visit our contact page to schedule a consultation.