If you’re launching an LLC, you’ve probably heard you need an operating agreement. This type of document can protect your business, your money, and your future.

At Portalatin Business Law Firm, we help entrepreneurs build strong legal foundations from day one. Our trilingual team makes the legal side feel less like a barrier and more like a step forward.

Key Takeaways

- An operating agreement outlines how your LLC is owned, managed, and run.

- Even if your state doesn’t require it, having one protects your business and avoids default laws.

- Key sections include ownership, decision-making rules, profit distribution, and exit plans.

- Using the right tools or legal help makes it easier to create an agreement that fits your business.

What Is an Operating Agreement?

An operating agreement is a legal document that outlines how your LLC works. It explains who owns what, how decisions get made, how profits are shared, and what happens if someone wants out.

Even if your state doesn’t require one, it’s still a smart move. Without it, your LLC is stuck following default state laws that might not fit your situation.

Do All LLCs Need an Operating Agreement?

No, not every state requires an operating agreement, but that doesn’t mean you should skip it. Having this document gives your LLC structure and protection.

Florida doesn’t require one by law, but strongly encourages it. Without one, Florida’s default LLC rules apply, which may not reflect how you want your business to operate.

6 Key Components of an Operating Agreement

A solid operating agreement spells out exactly how your LLC runs, giving your business clear direction and helping you avoid future headaches. Here’s what it usually includes.

1. Ownership Structure and Capital Contributions

This section lists who owns the LLC and how much of it. It also shows how much each person invested in the business, whether that’s cash, property, or services. This helps clarify:

- Who gets what percentage of profits

- Who holds decision-making power

- How new investments or partners are handled

2. Management Structure (Member-Managed vs Manager-Managed)

LLCs can be run in two ways:

- Member-managed: All owners (members) are involved in day-to-day operations.

- Manager-managed: The members appoint one or more managers to handle operations.

This section defines which structure your LLC follows and names the people in charge.

3. Voting Rights and Decision-Making Rules

Not all owners have equal say, unless you decide they do. This section lays out:

- How votes are counted (by ownership share, per person, etc.)

- What decisions need a vote (e.g., hiring, major expenses)

- What requires majority or unanimous approval

4. Profit Distribution and Taxation

Here’s where you spell out how profits (and losses) are shared. Even if owners have equal stakes, you might agree to divide money differently. It should also mention how the LLC is taxed, by default, or if you’ve elected something else (like S corp status).

By default, LLC profits and losses are typically split according to ownership percentage unless your operating agreement specifies otherwise.

5. Transfer of Interest and Dissolution

This part handles exits, disputes, or business closures:

- What happens if someone wants to leave or sell their share

- Rules for buying out a member

- What steps to take if the LLC shuts down

6. Amendments and Record-Keeping

Things change. This section explains how to update the agreement and what kind of records the LLC needs to keep, like meeting notes, voting results, or financial reports.

4 Benefits of Having an Operating Agreement

An operating agreement isn’t just legal protection, it’s a practical tool that helps you run your business smoothly. It answers the tough questions before they become problems. Here’s why having one is worth it.

1. Legal Protection and Limited Liability

An operating agreement shows that your LLC is a separate legal entity. That’s what helps protect your personal assets if the business is ever sued. Without it, courts may decide your LLC is just an extension of you, and that can put your personal finances at risk.

2. Avoiding Default State Rules

If you don’t write your own rules, your state provides them by default. These rules are generic and might not match your business setup. With an agreement, you stay in control of:

- How profits are split

- Who makes decisions

- What happens if a member leaves

3. Preventing Internal Disputes

It’s easier to run a business when everyone agrees on how things work. An operating agreement lays it all out in writing, no confusion, no guessing, no relying on memory. That can prevent arguments between partners down the road and provides for procedures when one does happen.

4. Professional Image and Credibility

Banks and investors take you more seriously when you have clear business documents. Many banks require an operating agreement before extending a line of credit for a business account. Investors often want to see how the company is structured before they commit money.

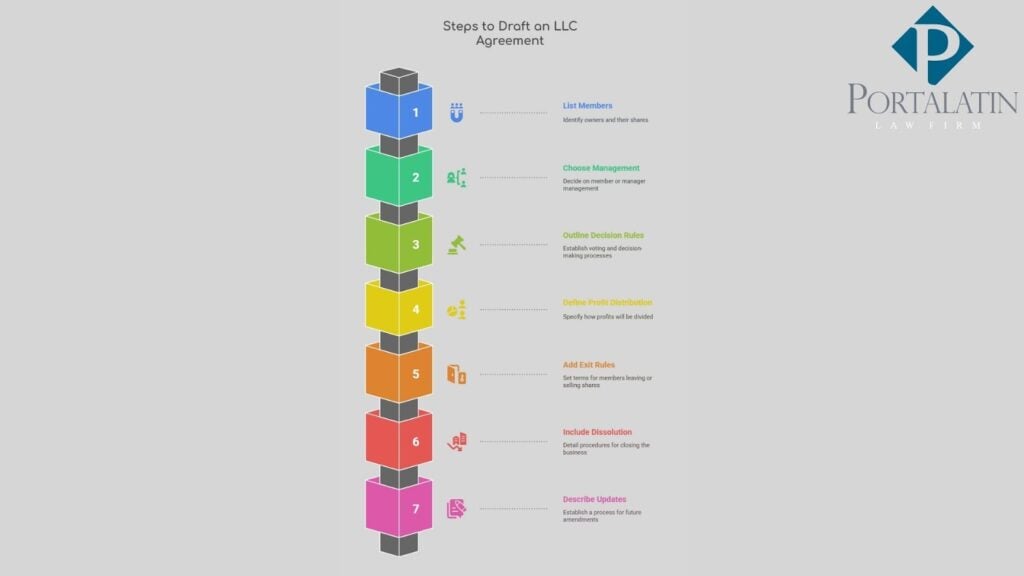

Step-by-Step Guide to Drafting an LLC Operating Agreement

- List all members and their ownership percentages

Start by naming each owner and showing what share of the business they hold. This sets the foundation for voting rights and profit splits. - Choose your management structure

Decide if your LLC will be member-managed (run by all owners) or manager-managed (run by one or more appointed managers). - Outline decision-making rules

Include how votes are handled and what decisions require unanimous approval. Be clear about how big decisions, like taking out loans or bringing in new members, are made. - Define profit distribution

Spell out how money will be divided. Even if ownership is 50/50, profit splits can be different if both members agree. - Exit and transfer rules

What happens if a member wants to leave or sell their share? This section helps prevent legal battles or awkward surprises. - Include a section on dissolution

If the business shuts down, the agreement should say how to wrap things up, paying debts, splitting assets, and closing accounts. - Describe how to make updates

Things change. Your agreement should include a clear process for making amendments in the future. - Sign and store the document

All members should sign the agreement and keep a copy. Some states may ask for it during audits or legal disputes.

3 Common Mistakes to Avoid

Operating agreements don’t have to be perfect, but skipping key details or copying the wrong template can cause serious issues later. Here are the mistakes LLC owners make most often, and how to avoid them.

1. Omitting Key Provisions

Leaving out important sections is a common error. If your agreement doesn’t clearly state how profits are shared or how decisions are made, you’re setting yourself up for confusion, or worse, legal disputes.

Make sure your agreement covers:

- Ownership percentages

- Voting rights

- Profit and loss distribution

- Procedures for exits, disputes, and dissolution

Without these, you’re relying on default state rules that may not reflect your actual intentions.

2. Using Generic or Inapplicable Templates

Not all templates are created equal. Many are too broad or don’t fit your state’s laws. Some skip over key areas entirely, while others include irrelevant legalese that makes things more confusing.

Before you use a template:

- Check that it’s made for your state

- Make sure it fits your LLC’s setup (single-member, multi-member, member-managed, manager-managed, etc.)

- Customize it instead of filling it in blindly

3. Not Updating the Agreement Regularly

Your LLC will grow and change. If your agreement stays frozen in time, it won’t reflect your current setup. This can cause problems when onboarding new members, changing roles, or restructuring ownership.

Review and update your agreement when:

- A member joins or leaves

- Ownership percentages shift

- Major policies or goals change

Protect Your Business the Smart Way

An operating agreement is an important layer of protection for your LLC.

At Portalatin Business Law Firm, we help entrepreneurs create strong legal foundations that actually support their long-term goals. From drafting custom agreements to protecting your brand through trademark registration, we align legal strategy with your business vision, clearly, proactively, and in your language.

If you’re ready to get your operating agreement right, we’re here to help. Contact us directly to start building the legal framework your business deserves.